Every company should verify that the

balance on the bank statement is consistent or compatible with the amounts in

the company's account balances in its General Ledger.

ESKA® Business Manager allows you to match

and compare your account balances to the bank’s account balances in order to

uncover any possible discrepancies.

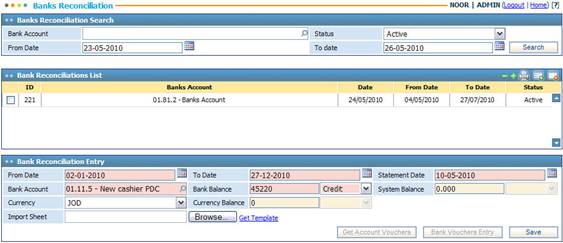

To view certain

pre-defined Bank Reconciliations, fill in the Banks Reconciliation Search

criteria fields with the proper details to filter down the retrieved Bank

Reconciliation records. If you wish to edit any Bank Reconciliation record, click

on the record needed and then proceed with making the changes you want. You can

deactivate an active record by simply clicking ![]() , or you can activate a

deactivated record by clicking

, or you can activate a

deactivated record by clicking ![]() .

.

To view a discrepancy

report, fill in the Banks

Reconciliation Search criteria fields with the proper details to filter

down the retrieved Bank Reconciliation records. Next, click on the record needed

and then click ![]() .

.

To perform a bank reconciliation, in the Bank Reconciliation List

block click ![]() and then in the Bank Reconciliation Entry

block perform the following:

and then in the Bank Reconciliation Entry

block perform the following:

§ Enter the range of Dates

for the reconciliation;

§ Enter the bank Statement

Date;

§ Select the Bank Account

to be reconciled;

§ Enter the Bank Balance

of the bank statement;

§ The system will

automatically retrieve the System Balance based on the Bank Account

selected for the period of time selected;

§ Select the preferred Currency

for the reconciliation. Accordingly, the system will automatically calculate

the Currency Balance;

§ Click ![]() to save your work. Accordingly, the Get

Account Voucher and Bank Vouchers Entry buttons will be enabled;

to save your work. Accordingly, the Get

Account Voucher and Bank Vouchers Entry buttons will be enabled;

§ Click ![]() to view the account voucher

details and check if the vouchers match the

bank statement;

to view the account voucher

details and check if the vouchers match the

bank statement;

§ Click ![]() to enter bank vouchers in case of any difference in the balance of the bank statement verses

the balance in the accounts on the company's general ledger;

to enter bank vouchers in case of any difference in the balance of the bank statement verses

the balance in the accounts on the company's general ledger;

Related Topics

Cash Management

Account Voucher Details

Entering Bank Vouchers

Currency Re-evaluation