Through the Payment sub-module you can perform payment transactions for previously created customer credit notes. You can also perform payment transactions that are not related to certain invoices or customers.

To do so, you need to go through the

following:

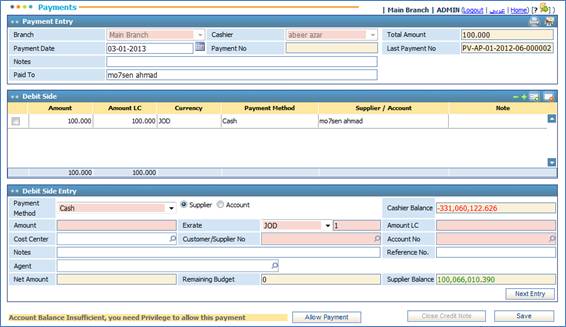

§ In the Payment Entry block, enter the Branch of the company;

§ Select the Cashier name. Note that cashiers can be defined in the Cashiers page;

§ Enter the Payment Date;

§ The Payment Number is automatically generated by the system;

§ The Last Payment Number is displayed by the system;

§ Enter any necessary Notes;

§ Specify the name of the person that this payment is Paid To;

Through the Debit Side Entry block, select the Customer radio button if you want to add this payment to a certain customer account, or select the Account radio button if you want to add the payment to a specific account number. Accordingly, the Customer/ Supplier Number field will be disabled;

§ Select the Payment Method (Cash, Cheque or Electronic Fund Transfer (EFT));

- If you choose the ‘Cheque’ payment method, you need to specify the Bank, Bank Branch, Payee, Cheque Number, Due Date, Cheque Notes, and Bank Branch Account number;

- If you choose the ‘EFT’ payment method, you need to specify the Bank, Bank Branch, Payee, and Bank Branch Account number. The EFT number will be automatically given by the system upon saving this type of payment.

§ Enter the paid Amount. By default the Currency will be the local currency of the company; yet, you can change it if needed. In all cases, the system will calculate the Amount in the Local Currency and provide the related Exchange Rate;

§ Select the Cost Centre related to this payment. Cost centres were previously defined through the Cost Profit Centres page of the General Ledger page;

§ Select the customer or supplier account number in the Customer/ Supplier Number field. If the customer or supplier has a predefined account number associated to him/ her, then the system will automatically retrieve the related Account Number. Otherwise, you need to select the Account Number from a list of accounts that were predefined in the Chart of Accounts page of the General Ledger page;

§ Enter any necessary Notes;

§ Enter a Reference Number for this receipt;

§ The Net Amount , Remaining Budget , and the supplier Balance will be auto generated;

If you want to include more payments, click again in the Debit

Side Entry block and then click ![]() . You then need to repeat the previous steps to enter more payments

by the same or other payment methods;

. You then need to repeat the previous steps to enter more payments

by the same or other payment methods;

§ Finally, click ![]() to save this payment

transaction;

to save this payment

transaction;

§ Upon saving each new payment within the same receipt, the system will calculate and update the Total Amount at the top of the page and entries will be listed in the Debit Side block;

§ Upon saving the payment, the ![]() button is enabled. Click this

button to redirect to the Expense Allocation page of the Accounts Payable

module to allocate expenses for this payment;

button is enabled. Click this

button to redirect to the Expense Allocation page of the Accounts Payable

module to allocate expenses for this payment;

§ Upon saving the payment, the ![]() button is enabled. Click this

button to close the debit note. Accordingly a list of all invoices and their Due

Dates, Total Amounts, Due Amounts and Paid Amounts

will appear. You may change the Paid Amount but note that it cannot be

greater than the Due Amount nor can it be greater than what the customer

paid in the receipt;

button is enabled. Click this

button to close the debit note. Accordingly a list of all invoices and their Due

Dates, Total Amounts, Due Amounts and Paid Amounts

will appear. You may change the Paid Amount but note that it cannot be

greater than the Due Amount nor can it be greater than what the customer

paid in the receipt;

§ Upon closing a credit note, the ![]() button appears. Click this

button to view all the customer's paid credit notes for the current payment.

You can edit the Paid Amount through this step. Simply enter the Paid

Amount in the Customer Paid Invoices block, then click

button appears. Click this

button to view all the customer's paid credit notes for the current payment.

You can edit the Paid Amount through this step. Simply enter the Paid

Amount in the Customer Paid Invoices block, then click ![]() . Note that the Paid Amount must be less than the Due

Amount;

. Note that the Paid Amount must be less than the Due

Amount;

§ Click ![]() to make a new payment entry

and repeat the previous steps.

to make a new payment entry

and repeat the previous steps.

Related Topics